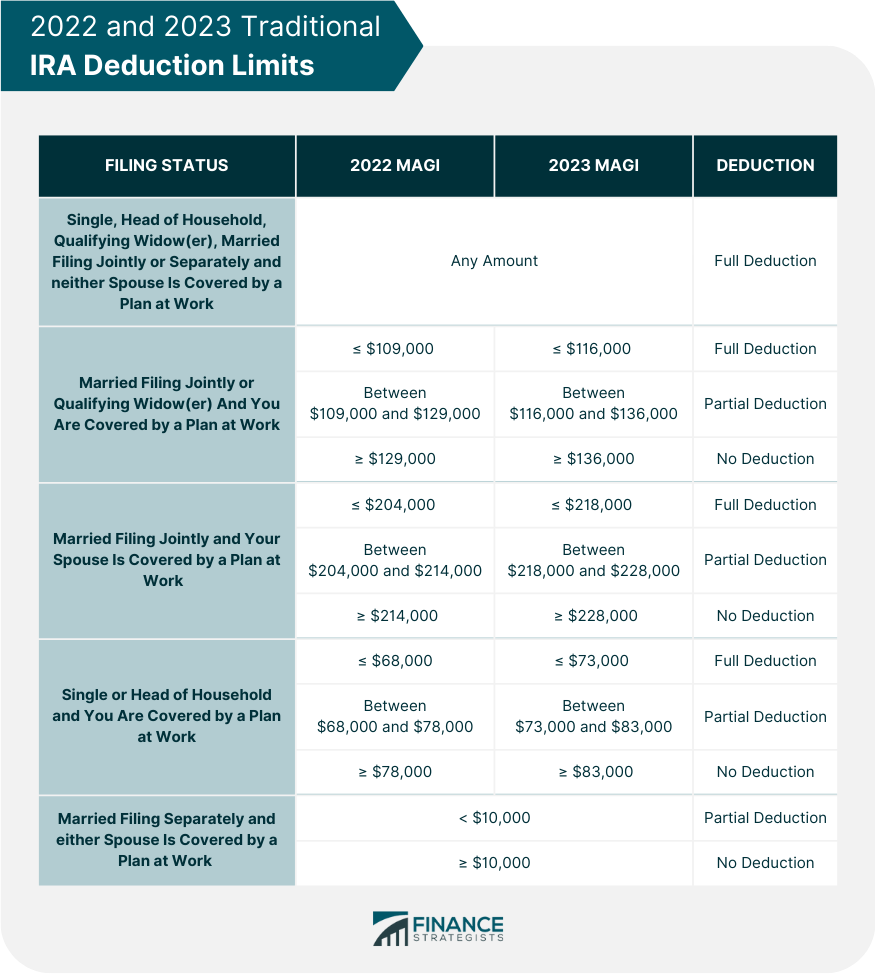

Deductible Ira Contribution Income Limits 2025. These limits saw a nice increase, which is due to higher. If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.

The ira contribution limit does not apply to: These limits saw a nice increase, which is due to higher.

Roth Contribution Limits 2025 Minda Lianna, For 2025, the ira contribution limit is $7,000 and $8,000 for individuals 50 or older. Find out if you can contribute and if you make too much money for a tax deduction.

IRA Contribution Limits 2025 Finance Strategists, These limits saw a nice increase, which is due to higher. The irs recently announced the 2025 ira contribution limits, which are $500 more than the limits for 2025.

IRA Contribution Limits in 2025 Meld Financial, In 2025, you can contribute up to $7,000 to a traditional. 2025 and 2025 roth ira income limits filing status

IRA Contribution Limits in 2025 Meld Financial, This is an increase from 2025, when the limits were $6,500 and $7,500,. Due to the valuable tax benefits of an ira, there are limits to how much you can contribute each year.

The IRS just announced the 2025 401(k) and IRA contribution limits, You can make 2025 ira contributions until the unextended federal tax deadline (for income earned in 2025). If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.

Ira Contribution Limit For 2025 Dix Vickie, Married filing jointly with a spouse who is covered by a plan at work: For all ira types, you can contribute up to $7,000 in 2025.

Limit Roth Ira 2025 Sadye Conchita, Traditional ira contribution limits for 2025. The maximum annual traditional ira contribution limit is $7,000 in 2025 ($8,000 if age 50 or older).

IRA Contribution Limits 2025 Finance Strategists, 2025 and 2025 roth ira income limits filing status These limits saw a nice increase, which is due to higher.

2025 Defined Contribution Limits Cammy Caressa, In 2025, you can contribute up to $7,000 to an ira or up to $8,000 if you're 50 or. For all ira types, you can contribute up to $7,000 in 2025.

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, These limits saw a nice increase, which is due to higher. In 2025, you can contribute up to $7,000 to a traditional.