Sba Loan Rates April 2025. In 2019, approximately 43% of small businesses applied for a loan—a number that dropped to 37% in 2025. Small business administration (sba) has announced expanded flexibility and accommodations for covid eidl and ppp.

Through april 30, 2025, 504 loan originations are down 1.2% compared to the same point in fy2025, a significant improvement from the 3.1% decline reported at the end of. 504 loan originations are down 3.1% compared to the same point in fy2025, a significant improvement from the 22.1% decline reported at the end of february 2025.

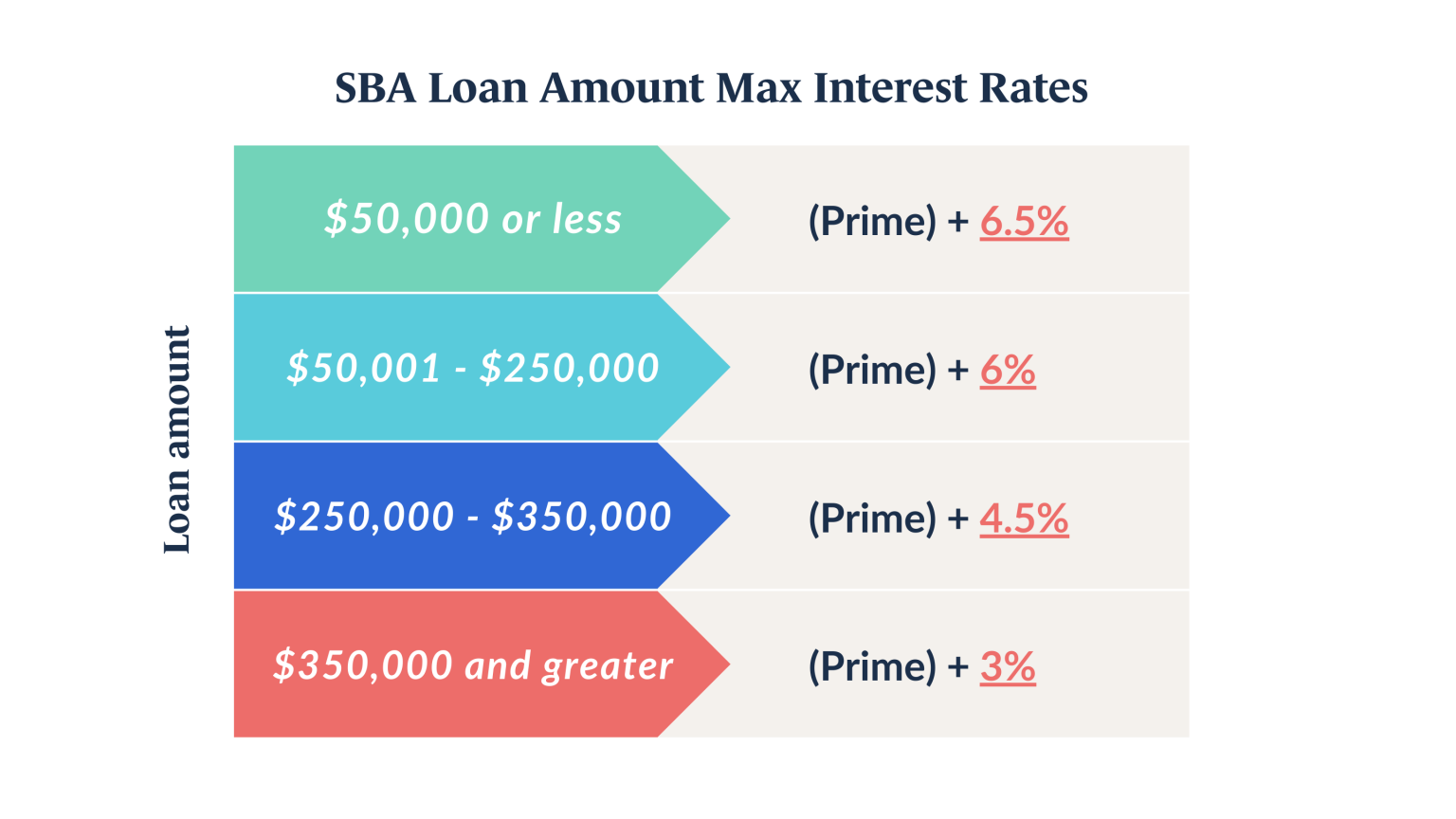

Important SBA Loan Interest Rate Changes Prospective Small Business, The 2025 sba loan rates hold significant financial implications for small businesses, influencing budgeting, financial planning, and growth strategies.

Why Develop an SBA 7(a) Small Loans Strategy Windsor Advantage, Thinksba is a nationwide sba 504 and 7a loan brokerage serving small business and entrepreneurs purchasing owner occupied real estate, acquiring a.

BCEDC BCEDC NEWS SBA 504 Loan Rates Released, A term loan refers to a lump sum borrowed, while a line of credit offers an amount against which the business can borrow.